02.08.2022 - The number of reports submitted to the NCSC rose slightly once again. Users of the smartphone bank WISE were targeted by phishing attempts. There were also more reports of the quality, quantity or type of goods ordered online not being delivered as expected. The NCSC gives tips on how to identify such webshops.

Identifying websites with fraudulent offers

Time and again, the NCSC receives reports of websites from which the goods ordered are not delivered at all, are of inferior quality or are even completely different. In such cases, the only option left to the customer is to try to contact the operator of the online shop, give the shop a bad review and, if appropriate, report the matter to the police. However, it does not need to go that far. It is often sufficient to take a closer look at the shop.

Fraudulent shops are typically not among the top search results in online searches. To counteract this, advertising is used on a massive scale, often in the form of Google or Facebook ads because of their broad reach. But does the shop appear elsewhere in the search results? If not, the website is probably too new, which could be an indication of fraudulent intent.

You should always take an initial look at the contact details, the "about us" section and the privacy policy. In particular, the contact details should be complete and not just include a meaningless email address or telephone number. Moreover, it should be clear whether the webshop operator actually sells goods or merely serves as a platform for individual merchants.

In a second step, the appearance of the webshop and the goods offered should be checked. Do the links work? Are there mistakes in texts or obvious website errors? Fraud should be assumed if the price is surprisingly low and availability high – in the case of goods that are hard to find elsewhere, for example.

Checking reviews of the shop also provides a good indication. Websites that rate trust are helpful in this respect. Bear in mind that shop operators can buy very good reviews. It can be a sign of fraud if there is an extraordinarily high number of 5-star reviews and at the same time many 1-star reviews and nothing in between. If there are no reviews to be found, the shop is most likely too new and therefore probably not trustworthy.

It is worth taking the time to check the shop – experience has shown that it takes more time and effort to track down undelivered or incorrect goods.

- Avoid visiting webshops via advertising links (Google or Facebook ads).

- Check the "about us" section – does it contain contact details and are they plausible?

- How does the website look, are there obvious operation errors?

- How is the webshop rated by other users?

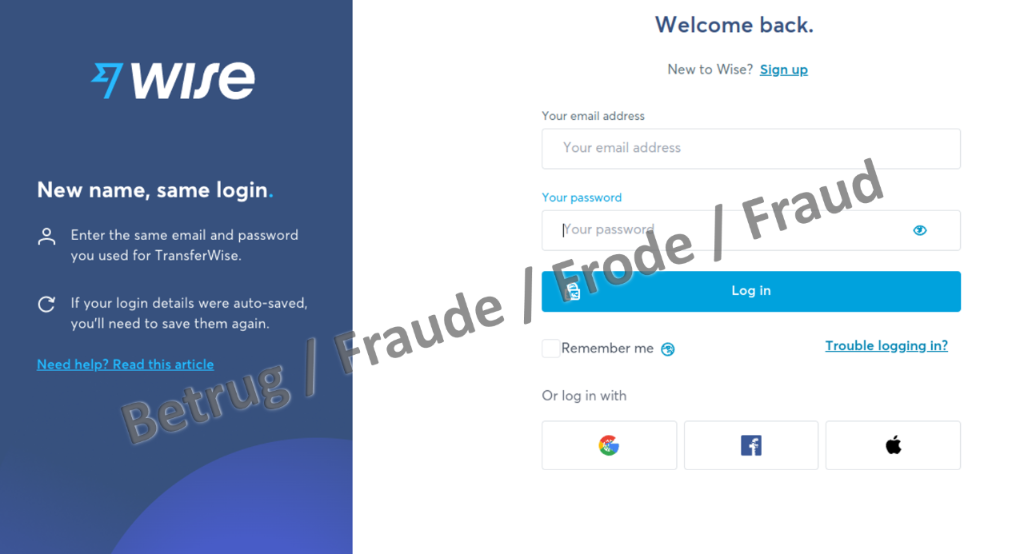

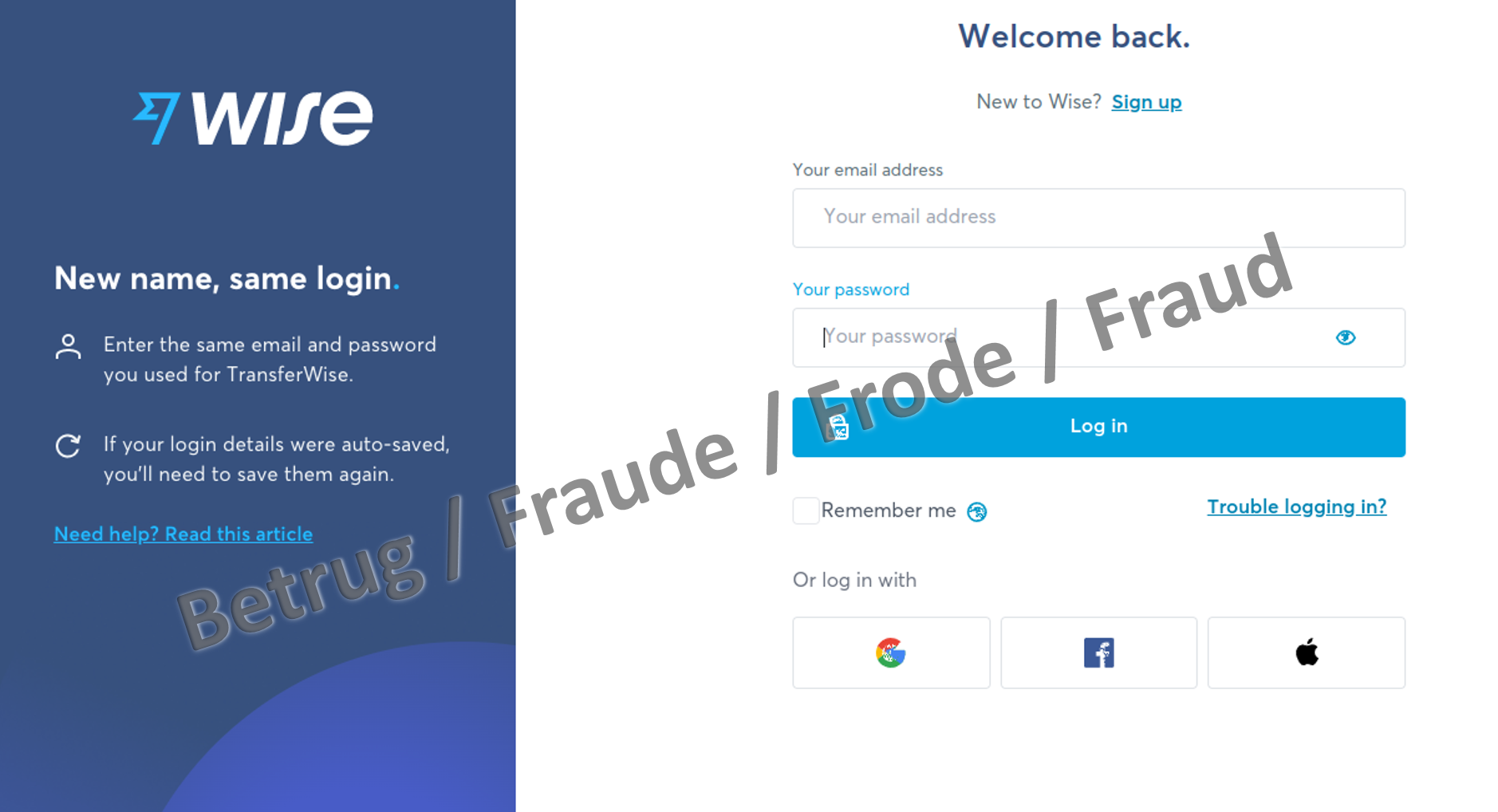

Phishing attacks on smartphone banks

Smartphone banks or neobanks are credit institutions that can be used almost exclusively online. Examples include WISE, N26 and REVOLUT. In recent days, several successful phishing attempts involving abusive use of the name of the smartphone bank WISE were reported to the NCSC.

After a successful phishing attempt, the phishers try to log in themselves via the browser. This triggers a second factor request. The credit card owner may now immediately confirm the second factor query, e.g. the mTAN or confirmation in the app, purely out of habit and not even perceive it as a second factor query, precisely because he or she is not used to this check in the smartphone app itself.

- If you are prompted to log in to the smartphone bank via your browser, never use the link provided and enter the web address manually.

- Check all mTAN approvals and those in the app very carefully. Cancel the process if you are unsure.

Current statistics

Last week's reports by category:

Last modification 02.08.2022