28.03.2023 - Using fake identities or hacked accounts to get at money is merely the first step for cybercriminals. The methods used to cover their tracks afterwards in order to evade the investigators are just as sophisticated as the fraud itself. The repayment of a fraudulently obtain sum of money to the victim's account shines a spotlight on the shadowy world of money laundering. The NCSC is using this an opportunity to report about the recruitment of money mules.

Cybercriminals deploy a huge arsenal of hacks and frauds to try and obtain money. As soon as they have succeeded, they then have the problem of accessing the funds obtained by fraud, extortion or theft, without getting caught in the act. This is not so easy, as money can be traced relatively easily. To make this tracing more difficult, the attackers use a variety of methods.

In most cases, the money is transferred abroad via several banks in different countries. Or they use the money to buy cryptocurrency, which they then put through a cryptocurrency mixer, or tumbler, to make tracing more difficult. Usually, they need innocuous accounts and accountholders to approve these transactions.

So cybercriminals use tempting job adverts to find financial agents ("money mules"), in order to misuse their innocuous bank accounts to move money around. However, anybody involved in such "transactions" is liable to prosecution for money laundering.

It is not easy to recruit accountholders, since they have to be kept in the dark about the real reasons for the money movements. Given the heavy penalties for money laundering, most people would probably not be willing participants.

A case reported to the NCSC last week shows that things do not always work out for the fraudsters. After the person who reported the incident had bought and paid for a motorway tax sticker on a classified ad platform, the "seller" contacted them to say that the account they had used was "overloaded" and tried to divert the payment to another account. At the same time, the reporting person received a refund of their money, which made them suspicious. What had happened?

The accountholder obviously did not want to act as a money mule, got cold feet and hurriedly refunded the fraudulently obtained funds. The fraudsters thus had to act quickly and convince their victim to transfer the money to another account. Naturally, the motorway tax sticker was never sent, but the person making the report was pleased that they had received their money back within a short time.

Money laundering as a sideline

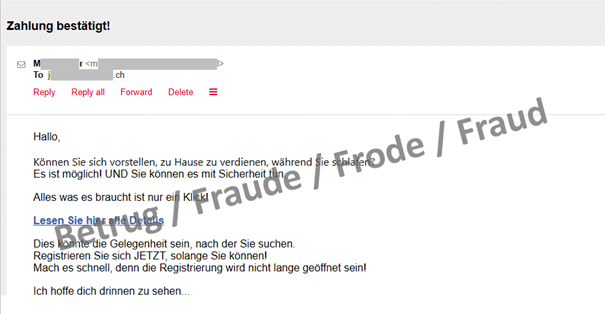

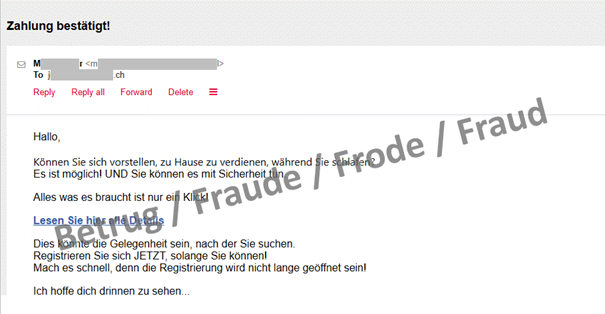

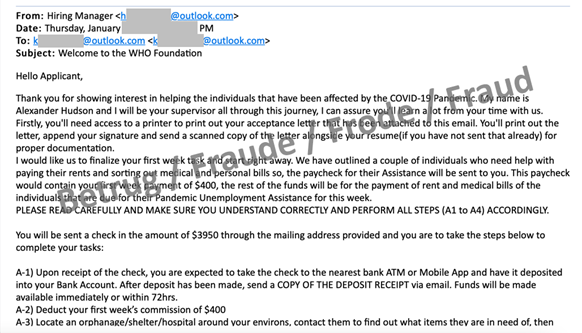

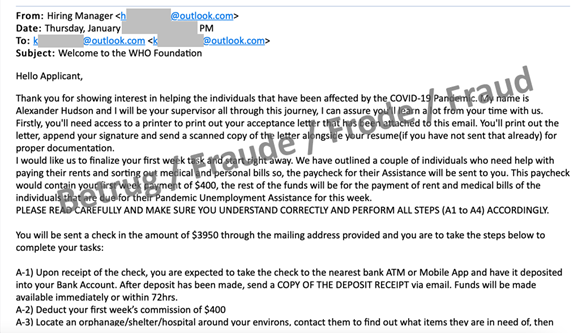

People are not just sought via job platforms. Emails are also used to find people who want to earn easy money on the side. Various stories are used to make the money flows plausible. For instance, donated funds need to be paid out to "those in need" on behalf of a charity.

Sometimes small services are requested, and these are then massively overpaid.

Money launderers as cryptocurrency investors

The NCSC also received reports of money laundering in the area of cryptoinvestments. People interested in cryptocurrency investments had remote maintenance software installed by the "Support unit" of the investment firm, and a bank account was opened in the name of the customer. Several large sums of money were then transferred to the account and subsequently transferred on somewhere else, "for test purposes". By the time the bank got in touch to ask for information about these money flows, the investment firm had long since ceased to exist.

Money laundering as a favour

In such cases, people receive unsolicited payments into their account from unknown sources. Shortly afterwards, they are contacted by someone claiming that the money was transferred "in error". Because of the apparent urgency, they request that the victims, instead of sending the money back, should transfer it to a third account.

Recommendations:

- Never make your bank accounts available to third parties;

- Do not respond to job adverts if they seem too good to be true;

- If you receive money on your account unexpectedly, you should never transfer it to another account. Instead, always send it back;

- Even if you worked as a financial agent yourself and thus possibly broke the law, you should definitely report the internet offence to the police.

- Inform your bank and the police about the transactions executed.

Current statistics

Last week's reports by category:

Last modification 28.03.2023