07.12.2021 - The number of reports received by the NCSC increased once again last week. Christmas is a time of abundant fraud attempts. Two of the cases reported this week were aimed at extracting additional money from victims as part of an ongoing investment fraud.

Fake fees for "cashing out"

Towards the end of the year, people spend a lot of money on Christmas presents. To do this, they sometimes draw on money that has supposedly been sitting in an online investment account and working hard for the account holders all year. If the account holders – who are not yet aware that the investment is a scam – now want to withdraw (cash out) the profits, they inform their "investment advisers". The "advisers" then prepare everything for the "withdrawal", including charging a fee, which has to be paid as quickly as possible, in an attempt to inflict further damage on their victims.

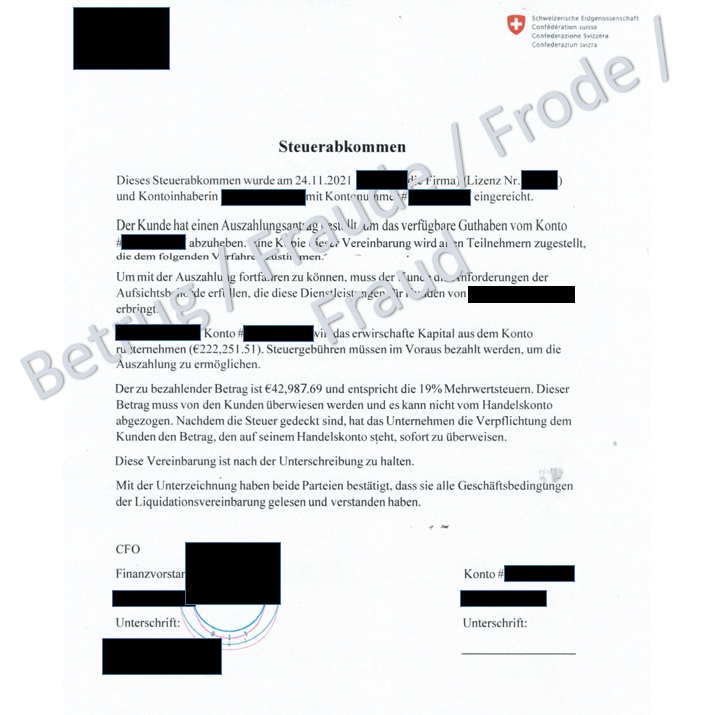

To make the whole thing look official, the fraudsters use the name and logos of federal authorities, such as the Federal Tax Administration (FTA), in their invoicing. In one case reported to the NCSC last week, a tax demand for 19% of the cash-out amount was issued, to be paid in advance by the customer.

One small detail in passing: VAT in Switzerland is 7.7%, not 19%. That is the VAT rate in Germany. A Swiss tax authority would certainly not make such a mistake.

Anyone who subsequently contacts the FTA to enquire whether the tax is correct, has a shock in store once they realise that they have been the victim of investment fraud the whole time, and are now supposed to transfer even more money to the fraudsters.

The attempt shown here is just one variant. In addition to forging tax forms, the fraudsters also cite fees from supposed supervisory authorities, sureties due to money laundering suspicions, and similar reasons for charging fees.

- Keep a close eye on the language used in correspondence. Do not trust official documents with obvious spelling mistakes;

- A serious financial institution will never charge advance fees for withdrawals;

- If you have the slightest suspicion that something is a scam, you should on no account make any further payments;

- Do not allow yourself to be put under pressure;

- Report the matter to your local cantonal police.

Advertising fraud on a fraud reporting website

Victims of investment fraud are often contacted again by the fraudsters after some time has passed. This time, the fraudsters pose as asset recovery companies with a record of success in retrieving assets lost to investment fraud – sometimes even as a specialist authority investigating such cases. The fraudsters also advertise such services online. If the victims contact the fraudsters, they start by gaining the victims' trust, fraudulently obtain various documents and then demand a fee for their apparent services (see weekly review 37).

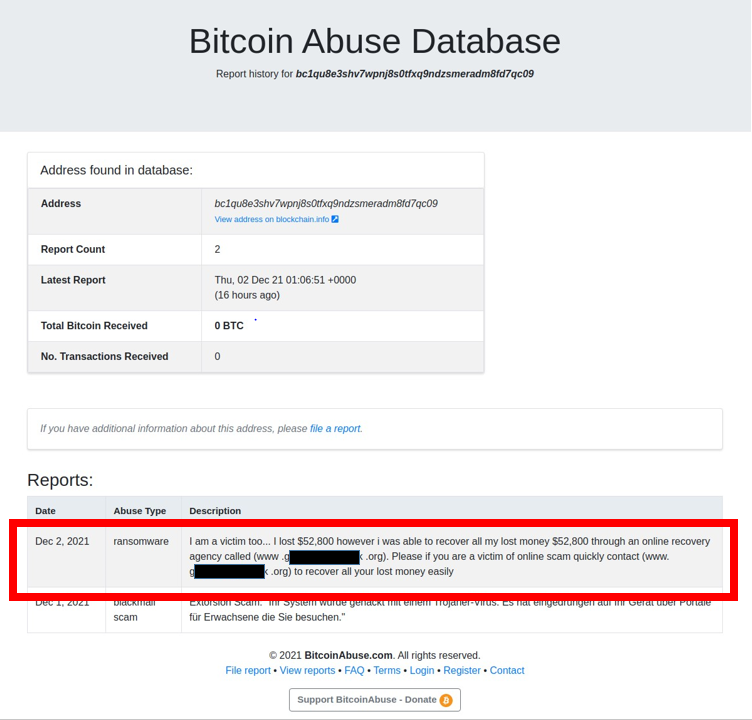

By chance, the NCSC discovered a particularly brazen attempt on the website of the Bitcoin Abuse Database. This website allows people to report cryptoaddresses that have been misused for fraud.

On the website, the fraudsters pretend to be victims themselves. They describe how an asset recovery company helped them to recover their money. The web address in the post leads to a company which describes itself as having successfully operated in the area of asset recovery for several years. However, the linked website only went live on 28 November 2021. So, far from being several years old, it is actually only a few days old.

On the website, the operators first offer a "free" advice session. Money is requested only once trust has been established.

- Be very suspicious if people contact you with apparent offers to help you recover your assets;

- Do not pay any fees charged to recover your (lost) money;

- If you were contacted by such a company, or if you contacted the company yourself, cease contact immediately;

- Do not allow yourself to be put under pressure.

Current statistics

Last week's reports by category:

Last modification 07.12.2021